Economic consequences of the corona pandemic for developing countries and emerging markets

The spread of the coronavirus is causing enormous socioeconomic damage worldwide especially for developing countries and emerging markets. In this post, we explore and discuss some of the main economic effects of the coronavirus pandemic in these countries.

Expected economic outcome

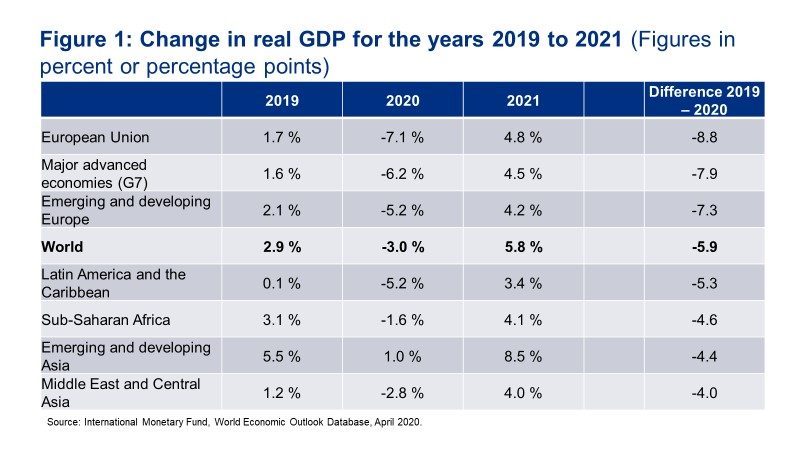

At first glance it seems that the economic impact of the pandemic will be less severe in developing countries and emerging markets than in the rest of the world. In April 2020, the International Monetary Fund (IMF) published forecasts for economic development in various regions of the world for the year 2020. For the global economy, a decline in real, i.e. inflation-adjusted gross domestic product (GDP), of three percent is expected. In the developed economies, the expected decline in GDP will even reach six to seven percent. However, for most developing countries and emerging markets the decline in real economic output is expected to be smaller. For emerging markets in Asia, modest economic growth is even on the cards. In Latin America, on the other hand, a deeper recession is expected with a decrease of 5.2 percent.

When considering these numbers, it should be borne in mind that growth rates – especially in African and Asian economies – were higher in 2019 than in the developed economies (see Figure 1). Yet, developing economies and emerging markets still perform relatively well in comparison with the rest of the world. While the difference between the growth rates in 2019 and 2020 is 5.9 percentage points worldwide, it is only 4.6 for sub-Saharan Africa, for example, and even less in Asia. Nonetheless, the external and internal socio-economic impact of COVID-19 on these countries contradict these moderate forecasts.

Export revenues of developing countries and emerging markets collapse

The first economic impact of the pandemic emerges through the high dependency of many economies on commodity exports. In general, the global economic downturn has led to a decline in demand for raw materials, especially oil and gas. Not only do developing countries and emerging markets face a limited demand for these exports, but also lower commodity prices on the world markets. This collapse of export revenues is leading to widening current account deficits and increasing foreign debt. For many countries this also represents government budget cuts as these are heavily dependent on exports of raw materials. These cuts, in turn, mean fewer resources for education, infrastructure, and other fundamental resources for long-run economic growth.

Capital withdrawal by industrialized countries weakens purchasing power and competitiveness

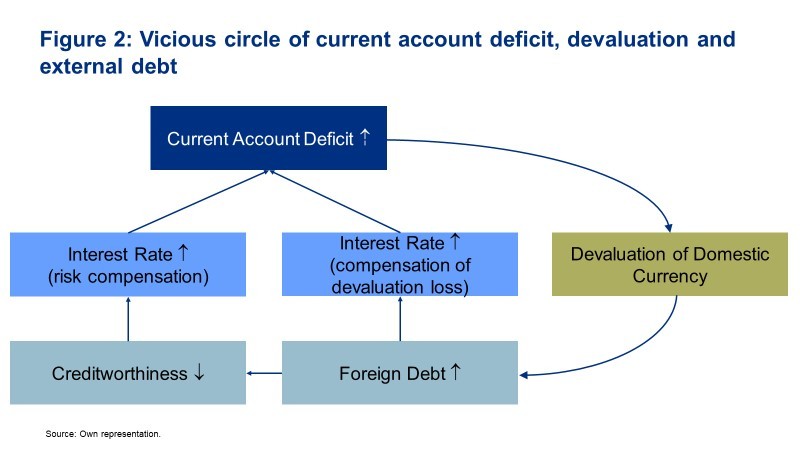

In addition to weakened commodity markets, the currencies of many developing countries and emerging markets are under a threat of devaluation as investors from industrialized countries are progressively withdrawing their capital. Without foreign capital, it will become increasingly more difficult for indebted developing countries and emerging markets to obtain fresh credit to finance their current account deficits and urgently needed investments.

If these countries export less and investors withdraw their capital at the same time, demand for national currency declines which results in currency devaluations. Imported products of essential need for developing countries and emerging markets would therefore have to be purchased at higher prices, which represents a loss in purchasing power for domestic consumers. Given the case that necessities, such as medicines and food, can no longer be paid for and imported, supply shortages may arise.

If many products must be imported, their prices will rise, as correspondingly will the overall inflation rate. As a result, the country loses international competitiveness because of higher production costs which leads to a further decline in its exports, additional devaluation and, thus, increasing prices. If this downward spiral goes unchecked, there is a risk of hyperinflation in extreme cases. Finally, the interplay of capital withdrawal, devaluation tendencies, rising inflation and growing foreign debt exacerbates creditworthiness.

Economic effects of the coronavirus outbreak in developing countries and emerging markets

All the negative economic impacts outlined so far affect developing countries and emerging markets, even if there is not a single coronavirus infection there. Nonetheless, the outbreak in these countries represents an additional source of socioeconomic distress. The necessity of social distancing, production shutdowns and constrains for business pose more challenges for developing countries and emerging markets than it does for more developed economies. Worldwide, the economic slowdowns of the last months have represented production losses, less revenues for businesses and even supply shortages for consumers. Unlike for many industrialized countries, governments in many developing countries and emerging markets do not have the economic and even political capacity to support people in need through transfer payments, provide companies with loans, or finance economic stimulus packages.

The lack of social security exacerbates the impact of the crisis

In addition to the lack of fiscal policy options for financing crisis containment and economic recovery, there are two further problematic aspects that make successful pandemic control in many countries unlikely:

For one, the medical infrastructure in most countries is so poorly developed that their capacities will very quickly be overstretched even with a moderate infection rate. For example, even under normal conditions, South Africa’s comparatively well-developed health care system, compared to other African countries, is already at the limit of its capacity with over seven million HIV-infected people.

Also, given the lack of hygienic, socio-spatial and management capacities in most countries, the infection rate cannot be kept under control once the epidemic has broken out. The Indian example, where millions of migrant workers carry the virus from the overcrowded cities back to their villages, illustrates that in the face of the daily struggle for survival, the call for “social distancing” will go unheard.

Life at or below the poverty line is part of daily experience for most people in developing countries. In the current Bertelsmann Stiftung’s Transformation Index BTI, 76 of 137 countries have a very low level of socioeconomic development. Thus, in more than half of all countries examined by the BTI 2020, poverty and inequality are widespread and indicate firmly established patterns of exclusion. Despite a general decline in extreme poverty rates, social inequality has increased over the past decade. This problematic trend will be exacerbated if prices rise and supply is short for basic necessities, especially in countries with a large informal sector and thus a high social vulnerability of the working poor. In this respect, the pandemic is about to evolve into a global social crisis of unprecedented magnitude.

Conclusion and outlook

Many developing countries and emerging markets were already in a problematic economic situation before the outbreak of the coronavirus. The corona pandemic aggravates this situation through falling raw material prices; declining exports; growing foreign debt; a withdrawal of capital which fosters devaluation (see Figure 2); as well as production and employment losses that can lead to supply bottlenecks.

This results in a dilemma: Particularly in the pandemic period, many developing countries and emerging markets are dependent on financial resources from the developed economies to be able to purchase urgently needed products from abroad. These include not only food but also medical supplies. At the same time, however, the industrialized countries are withdrawing their capital from these regions. In addition, their willingness to grant loans is diminishing due to the declining creditworthiness of developing countries and emerging markets.

Ultimately, however, the developing countries and emerging markets are manifestly dependent on financial support from industrialized countries. Without this aid, a humanitarian disaster is imminent. This is particularly true for most African countries. If Africa is left alone with its medical and economic problems, this is likely to raise migration pressures significantly. This could in turn overburden Europe’s economic, social and political capacities.

Supporting developing countries and emerging markets in solving medical and economic challenges is therefore not only a humanitarian imperative and a multilateral desideratum, but also in the well-understood self-interest of European states – even if they are facing enormous problems in view of the pandemic themselves.

If you are interested in this topic click here to get access to the full study.

Sources

Hartmann, Hauke (2020). „High vulnerability to crisis: The results of the BTI 2020 in the context of COVID-19“. Policy Brief 2020/01. Gütersloh: Bertelsmann Stiftung. https://www.bti-project.org/content/en/downloads/press/Policy_Brief_2020-01_EN.pdf. Fetched 11.05.2020.

ILO (International Labour Organization) (2018). „More than 60 per cent of the world’s employed population are in the informal economy”. www.ilo.org/global/about-the-ilo/newsroom/news/WCMS_627189/lang–en/index.htm. Fetched 11.05.2020.

IMF (International Monetary Fund) (2020). „The IMF’s Response to COVID-19”. www.imf.org/en/About/FAQ/imf-response-to-covid-19#Q5. Fetched 11.05.2020.